Mark Lindsay Net Worth refers to the monetary value of all assets owned by Mark Lindsay minus any liabilities.

Understanding Mark Lindsay Net Worth is essential for assessing his financial status. It provides insights into his income sources, investment strategies, and overall wealth. Notably, the concept of net worth has evolved since its historical roots in accounting, becoming a crucial metric in modern financial planning.

This article explores the components of Mark Lindsay Net Worth, discusses its significance, and examines the factors that have contributed to its growth over time.

Mark Lindsay Net Worth

Understanding the key aspects of Mark Lindsay Net Worth is essential for evaluating his financial standing and assessing his wealth.

- Assets

- Liabilities

- Income Sources

- Investment Strategies

- Cash Flow

- Debt Management

- Tax Implications

- Estate Planning

These aspects are interconnected and play a crucial role in determining Mark Lindsay's overall financial picture. For instance, the balance between assets and liabilities provides an indication of his financial leverage, while income sources and investment strategies shed light on his ability to generate and grow wealth. Moreover, effective cash flow management, debt management, and tax planning are essential for preserving and maximizing his net worth. Lastly, estate planning ensures the orderly distribution of his assets after his passing.

Assets

Assets are a fundamental component of Mark Lindsay Net Worth, representing the resources and valuables he owns. They encompass various categories, each with its own implications for his financial standing.

- Cash and Cash Equivalents: This includes physical cash, money in bank accounts, and other liquid assets that can be easily converted into cash. It provides a cushion for unexpected expenses and opportunities.

- Investments: Mark Lindsay's investment portfolio may include stocks, bonds, mutual funds, and real estate. These assets have the potential to generate income and appreciate in value, contributing to his overall wealth.

- Property and Equipment: This category encompasses real estate, vehicles, and any other physical assets that are owned and used by Mark Lindsay. They represent a significant portion of his net worth and can provide rental income or other benefits.

- Intellectual Property: This includes patents, trademarks, copyrights, and other intangible assets that have economic value. Intellectual property can be a valuable source of income and can enhance Mark Lindsay's overall net worth.

In summary, Mark Lindsay's assets form the foundation of his net worth, providing him with financial security, income-generating potential, and the ability to pursue future opportunities.

Liabilities

Liabilities are the obligations and debts that reduce Mark Lindsay's Net Worth. Understanding and managing liabilities is crucial for maintaining financial stability and long-term wealth growth.

- Outstanding Loans: These include mortgages, auto loans, and personal loans. They represent borrowed funds that must be repaid with interest, impacting cash flow and overall financial leverage.

- Accounts Payable: These are unpaid invoices and bills owed to suppliers, contractors, or other businesses. Prompt payment of accounts payable is essential for maintaining good credit and business relationships.

- Taxes Payable: Mark Lindsay is responsible for paying various taxes, such as income tax, property tax, and sales tax. Failure to meet tax obligations can result in penalties and legal consequences.

- Deferred Revenue: This liability arises when payment is received for goods or services that have not yet been delivered or performed. Deferred revenue must be recognized as income over time, as the services are rendered or products are delivered.

In conclusion, liabilities play a significant role in determining Mark Lindsay's Net Worth. By effectively managing liabilities, minimizing interest expenses, and maintaining a healthy debt-to-income ratio, he can enhance his financial resilience and position himself for long-term success.

Income Sources

Income sources constitute a critical aspect of Mark Lindsay Net Worth, as they represent the inflows of funds that contribute to his overall wealth. These sources encompass a range of activities and investments that generate revenue and ultimately impact his net worth.

- Business Income:

As a business owner or entrepreneur, Mark Lindsay may derive income from the operations and profits of his ventures. This includes revenue from sales, services rendered, or other business activities.

- Investment Income:

Mark Lindsay's investment portfolio may generate income in the form of dividends, interest, or capital gains. These investments could include stocks, bonds, mutual funds, or real estate.

- Royalties and Intellectual Property:

If Mark Lindsay holds patents, trademarks, or copyrights, he may receive royalties or other payments for the use or licensing of his intellectual property.

- Other Income:

This category includes any additional sources of income, such as rental income from properties, annuities, or even income from creative endeavors like writing or music.

Understanding the composition and stability of Mark Lindsay's income sources is crucial for assessing his financial health. Diversifying income streams and ensuring a steady flow of revenue are key elements in building and maintaining a strong net worth.

Investment Strategies

Investment strategies play a critical role in shaping Mark Lindsay Net Worth by guiding how his assets are allocated and managed to maximize returns and achieve financial goals. These strategies encompass various elements, each contributing to the overall health and growth of his net worth.

- Asset Allocation:

This involves determining the optimal mix of asset classes, such as stocks, bonds, and real estate, based on risk tolerance, time horizon, and financial objectives.

- Diversification:

Spreading investments across different asset classes and sectors reduces risk and enhances portfolio stability. This ensures that Mark Lindsay's net worth is not overly dependent on any single asset or industry.

- Investment Selection:

Involves carefully selecting individual investments within each asset class, considering factors such as growth potential, income generation, and risk profile. Each investment decision contributes to the overall performance of Mark Lindsay's portfolio and, subsequently, his net worth.

- Rebalancing:

Periodically adjusting the portfolio to maintain the desired asset allocation is crucial. As market conditions change and individual investments perform differently, rebalancing ensures that Mark Lindsay's net worth remains aligned with his long-term financial goals.

By employing a well-defined and disciplined investment strategy, Mark Lindsay proactively manages his net worth, increasing the potential for long-term growth while mitigating risks. The combination of these strategies helps preserve and enhance the value of his assets, contributing significantly to his overall financial well-being.

Cash Flow

Cash flow plays a critical role in shaping Mark Lindsay Net Worth. Positive cash flow, or the net inflow of cash, is essential for maintaining financial stability, funding growth, and increasing overall wealth. Conversely, negative cash flow can strain resources, limit investment opportunities, and ultimately erode net worth.

Mark Lindsay's cash flow is primarily influenced by the performance of his businesses and investments. Strong cash flow from operations, coupled with prudent investment decisions that generate income, contributes to a healthy net worth. For instance, if Mark Lindsay's business generates consistent profits and his investments yield dividends and capital gains, he will likely experience positive cash flow, allowing him to reinvest, expand his ventures, and grow his net worth.

Understanding the connection between cash flow and net worth empowers Mark Lindsay to make informed financial decisions. By analyzing cash flow patterns, he can identify opportunities to optimize his business operations, allocate resources efficiently, and mitigate risks. Moreover, it helps him assess the sustainability of his wealth and plan for the future. By ensuring a steady flow of positive cash flow, Mark Lindsay lays the foundation for long-term financial success and the preservation of his net worth.

Debt Management

Debt management is a crucial aspect of Mark Lindsay Net Worth, as it directly influences his financial leverage, liquidity, and overall financial health. Effective debt management strategies can contribute to preserving and growing net worth, while excessive or poorly managed debt can erode wealth and limit financial flexibility.

- Debt Consolidation: Combining multiple debts into a single loan with potentially lower interest rates and more favorable repayment terms. This can simplify debt management, reduce monthly payments, and improve cash flow.

- Debt Repayment Plan: Creating a structured plan to pay off debts systematically, allocating funds to different debts based on factors such as interest rates, timeframes, and financial goals.

- Negotiation and Restructuring: Engaging with creditors to negotiate lower interest rates, extended repayment periods, or other concessions. This can help reduce the burden of debt and preserve assets.

- Debt Avoidance: Prudent financial planning and disciplined spending habits can help avoid excessive debt accumulation. This involves evaluating the necessity of new debt, considering alternative financing options, and maintaining a reasonable debt-to-income ratio.

By implementing effective debt management strategies, Mark Lindsay can optimize his financial position, free up cash flow for investments and growth, and safeguard his net worth against potential risks. Conversely, neglecting debt management can lead to financial distress, reduced investment opportunities, and a decline in net worth over time.

Tax Implications

Tax implications play a significant role in shaping Mark Lindsay Net Worth. Understanding the various tax laws and regulations that apply to his income, investments, and assets is crucial for preserving and growing his wealth.

- Income Tax:

Mark Lindsay is subject to income tax on his earnings from various sources, such as business profits, investment income, and royalties. The amount of tax owed depends on his taxable income and the applicable tax rates.

- Capital Gains Tax:

When Mark Lindsay sells or disposes of assets, such as stocks, bonds, or real estate, he may be liable for capital gains tax on any profits realized. The tax rate and treatment depend on the type of asset and the holding period.

- Estate Tax:

Upon Mark Lindsay's passing, his estate may be subject to estate tax. This tax is levied on the value of his assets at the time of death, potentially reducing the net worth passed on to his beneficiaries.

- Property Tax:

Mark Lindsay is responsible for paying property tax on any real estate he owns. This tax is typically assessed annually based on the value of the property.

By carefully considering the tax implications associated with his financial decisions, Mark Lindsay can minimize his tax burden, optimize his investment strategies, and preserve his net worth over the long term. Failing to address tax implications can result in unnecessary financial losses and hinder his ability to accumulate wealth.

Estate Planning

In the context of Mark Lindsay Net Worth, estate planning plays a crucial role in preserving and distributing his wealth after his passing. It encompasses a range of strategies and legal arrangements aimed at minimizing taxes, maximizing the value of assets, and ensuring the orderly distribution of his estate.

- Asset Distribution:

Estate planning allows Mark Lindsay to specify how his assets should be distributed after his death, ensuring that his wishes are carried out and potential disputes among beneficiaries are minimized.

- Tax Minimization:

Through various estate planning techniques, Mark Lindsay can reduce the tax burden on his estate, preserving more of his wealth for his beneficiaries.

- Trust Establishment:

Establishing trusts, such as revocable or irrevocable trusts, can provide flexibility, asset protection, and privacy in managing and distributing assets.

- Healthcare Directives:

Estate planning also involves creating healthcare directives, such as living wills and healthcare proxies, to ensure that Mark Lindsay's wishes regarding his medical care are respected if he becomes incapacitated.

Overall, estate planning is an essential aspect of managing Mark Lindsay Net Worth, allowing him to protect his legacy, minimize taxes, and ensure the orderly distribution of his assets according to his wishes. It provides peace of mind and safeguards his wealth for the benefit of his loved ones and future generations.

Frequently Asked Questions about Mark Lindsay Net Worth

This FAQ section aims to address common questions and provide clarity on various aspects of Mark Lindsay Net Worth.

Question 1: How is Mark Lindsay Net Worth calculated?

Answer: Mark Lindsay Net Worth is calculated by subtracting his total liabilities from his total assets. Assets include cash, investments, properties, and other valuables, while liabilities include outstanding loans, unpaid invoices, and taxes owed.

Question 2: What are the primary sources of Mark Lindsay's income?

Answer: Mark Lindsay generates income through various sources, including his business ventures, investments, royalties from intellectual property, and other income streams.

Question 3: How does Mark Lindsay manage his debt?

Answer: Mark Lindsay employs a range of debt management strategies, such as debt consolidation, repayment plans, and debt avoidance, to optimize his financial position and preserve his net worth.

Question 4: What tax implications affect Mark Lindsay Net Worth?

Answer: Mark Lindsay is subject to various taxes, including income tax, capital gains tax, estate tax, and property tax. Understanding and addressing these tax implications is crucial for preserving and growing his net worth.

Question 5: How does estate planning impact Mark Lindsay Net Worth?

Answer: Estate planning allows Mark Lindsay to control the distribution of his assets after his passing, minimize taxes, and ensure his wishes are carried out. It plays a vital role in preserving and passing on his wealth.

Question 6: What are the key factors influencing Mark Lindsay Net Worth?

Answer: The key factors influencing Mark Lindsay Net Worth include his income sources, investment strategies, debt management, tax implications, and estate planning decisions. Effective management of these aspects contributes to the growth and preservation of his net worth.

In summary, understanding these FAQs provides valuable insights into the various components and dynamics that shape Mark Lindsay Net Worth. These factors collectively contribute to his overall financial well-being and allow him to make informed decisions to preserve and grow his wealth.

The next section will delve deeper into the investment strategies employed by Mark Lindsay to generate and manage his wealth.

Tips for Building Your Net Worth

Building and maintaining a strong net worth is essential for financial security and long-term success. Here are five actionable tips to help you grow your net worth:

Tip 1: Increase Your Income: Explore ways to increase your income through career advancement, side hustles, or investments.

Tip 2: Reduce Expenses: Analyze your spending habits and identify areas where you can cut back on unnecessary expenses.

Tip 3: Invest Wisely: Diversify your investments across different asset classes to minimize risk and maximize returns.

Tip 4: Manage Debt Effectively: Prioritize high-interest debts and consider debt consolidation or refinancing to reduce interest payments.

Tip 5: Plan for the Future: Create a comprehensive financial plan that includes saving for retirement, unexpected expenses, and estate planning.

By following these tips, you can take control of your finances, grow your net worth, and achieve your financial goals.

The next section will delve into the importance of estate planning for preserving and passing on your wealth.

Conclusion

This in-depth exploration of Mark Lindsay Net Worth has illuminated the multifaceted nature of wealth management and the interplay between various financial aspects. Understanding the components of net worth, including assets, liabilities, income sources, and investment strategies, is essential for assessing an individual's financial health.

Key insights from this analysis include the importance of effective debt management, prudent tax planning, and meticulous estate planning. These elements collectively contribute to preserving and growing net worth, ensuring financial stability, and safeguarding wealth for future generations.

Jimmy Dore Net Worth: Unlocking Financial Success In Entertainment

How To Build Wealth Like Tayshia Adams: Secrets Of Her Net Worth Revealed

Uncovering The Secrets Of Andy Elliott's Net Worth

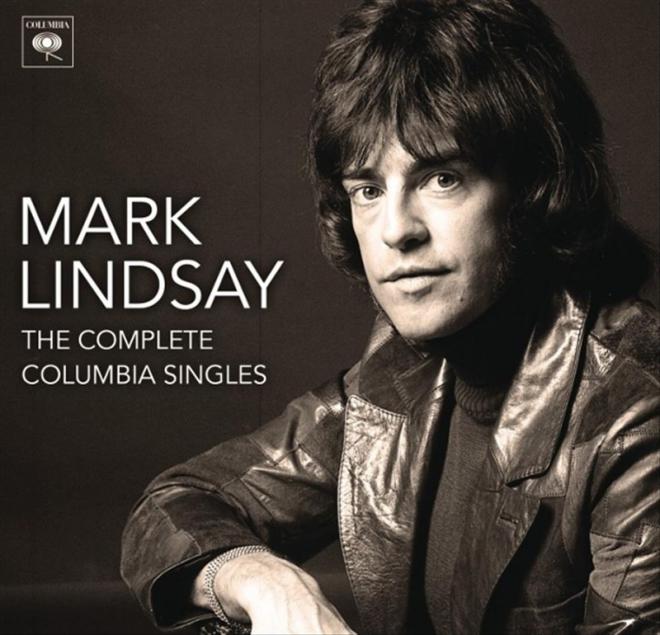

Mark Lindsay Net Worth 2024 Wiki Bio, Married, Dating, Family, Height

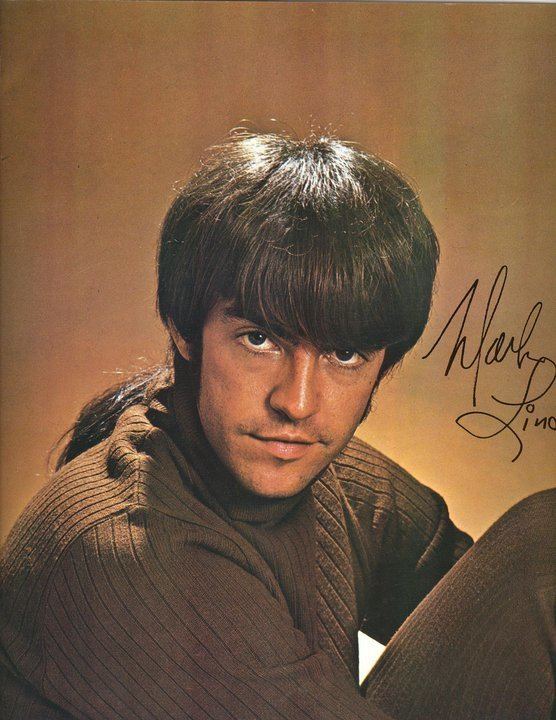

Mark Lindsay is the former lead singer of Paul Revere & The Raiders

Mark Lindsay Alchetron, The Free Social Encyclopedia

ncG1vNJzZmilqam%2FqriNrGpnraNixKa%2F02ZpZ5mdlsewusCwqmebn6J8rq3RpGSloZ6ZwKLFjKecrWWnpL%2B1tI2hq6ak